Debt consolidation is necessary if you are facing difficulties in timely payment of your loan installments and credit card bills, or if you have a large amount of debt. Both of these things negatively affect your credit score. If you carry a high balance on your credit cards, your credit scores will be lowered. You want to seek debt consolidation with the best debt consolidation company to relieve the stress caused by being in debt.

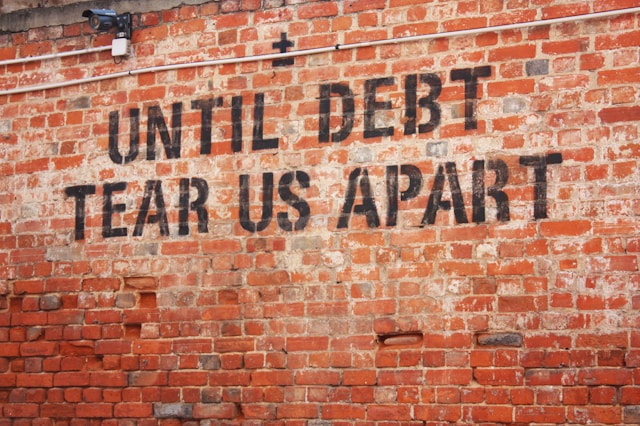

Debt is something that is outstanding on your part. It mostly constitutes money borrowed from somebody due to one or the other reason. Many people use debt to manage their affairs like purchasing houses, cars and doing many other expensive things that would otherwise be impossible for them to do. Many organizations use debt for investment in their business.

Accomplishment of debt is constructive, as it gives significant amount of cash in hand, but on the other side, getting clear of debt is also very imperative.

Selection of either of the option depends upon amount and type of debt. Whatever option you choose, first you need to ensure some prerequisites. Organise yourself and make a list of your expenses and income. Compare them and then decide what amount you can put aside for returning the debt. If your income is more than your expenses, you can easily manage the debt on your own. But, if the expenses exceed the income then you have to look for some other means, which could help you in the payment of the debt.

If you have distressing debt burden, you need to look for the best debt consolidation company. They will advise you of the best debt consolidation product that will help you get out of debt in the shortest time possible. The best debt consolidation company will help your credit scores improve as you lower your account balances and pay off your debts.

There are many companies available to help you obtain debt consolidation. The debt counselor will review your finances and help you choose the best debt consolidation program. There are several choices to consolidate your account including a consolidation loan, debt consolidation without a loan, and debt settlement.

You must select the best debt consolidation company in order to get out of debt such as EasyFind Singapore Licensed Moneylender. The best debt consolidation companies will know how to negotiate with your creditors and lenders to obtain the lowest interest rates available for a debt consolidation program. They will be able to get your fees reduced or eliminated. If you are seeking a consolidation loan for your accounts, they will help you get a loan with the best possible rates and payment term so that your monthly payments will be affordable. Sometimes you will want to obtain debt settlement in order to become debt free, and the best debt consolidation company will have a good rapport with the financial institutions so that you can obtain the best settlement offer to get your loans paid off.

Be cautious, though. Some credit counseling services will have upfront fee. These fees can range from a few hundred to up to thousands of dollars. This, in fact, does not get applied yet to your balances from creditors. So a part of your supposed savings will actually go to the professional fee.

Since you do not want to live with the stress of debt, the debt consolidation company will also be able to help you find where you can cut your expenses and start saving money. You will need to avoid using your credit cards, so save one for emergencies and cut up the rest. The best debt consolidation company cannot keep you out of debt if you continue overspending.

Manage Your Credit Cards Manage Your Debts

One important thing that many people fail to understand is that a credit card is not cash. This is why many are deep in debt. They treat credit cards as money and use them indiscriminately. When used wisely and in moderation, though, credit cards become a very useful and helpful tool in managing finances.

Whether you’re a new credit card holder who is sorely tempted to take your credit card on a buying spree, someone who has been in credit card debt before and managed to get out of debt, or someone in between, here are some tips that can help you manage your credit card so you can avoid the pains that come with financial death.

Tip #1: Plan your credit card purchases.

Planning your credit card purchases is one of the important steps you can take towards managing your credit card debts. Before using your credit card on a purchase, ask yourself how you will pay for it when the credit card bill comes. It’s also important that you assess the items you intend to purchase — is an item something you need or just something you want? If it’s the latter, you may just be experiencing an impulse to buy something. Keep your credit card in your wallet and walk away. By using your credit cards only on planned and needed purchases, you will save yourself long-term grief caused by mile-high credit card debts.

Tip #2: Spend within your credit card limit.

Manage your credit card debts and payment by spending within your credit limit. It’s wise to know how much credit you have left in your credit card before purchasing anything. It’s also wise to not go over two-thirds of your credit card limit.

Tip #3: Keep credit card statements.

Don’t throw away your credit card statements. If you receive electronic credit card statements, print them out and keep your records together for future reference. Keep in mind that credit card fraud is rampant and this is one reason many people are in debt — they are in debt for purchases they never made. If there are any transactions you do not recognize, report it to your credit card company right away. It also pays to make a list of credit card purchases you make each month. This way, you can compare your list with the credit card statement. Again, if your list and the credit card statement do not match, contact your credit card company as soon as possible.

Tip #4: Know how much you need to pay and when.

Save yourself finance charges and late payments by knowing how much you need to pay and when you need to pay. Unless you have a low-interest rate on your purchases, try to pay off all your credit card debts each month. Most credit card companies give you at least two weeks to send payment. If you’re paying with a check, mail your payment a week before it’s due. If your credit card statement is late, call the number on the back of your credit card and find out how much your debt is and what the minimum payment is. As soon as you find out this information, send the payment right away.

Tip #5: Consider debt consolidation

Look into debt consolidation options, which can make it much easier for you to pay off your credit card debts. It’s also wise to seek the help of a financial adviser, especially if your financial problems are already too difficult for you to solve on your own. Financial advisers could help you in managing your credit card debts. Some advice they might give you is to seek financial assistance through bank loans. However, before going ahead with a debt consolidation agency, do your due diligence on the company. Research about the agency and know its background. You want to receive the soundest financial advice so you can get out of credit card debt.

Of course, the best way to stay out of credit card debt is to minimize using your credit cards. In this case, self-control is an important trait to have.